Newton's Law of Gravity

Rules of the Game

part 2

Breathe, less is more, there is beauty in simplicity

Mental Models

Frameworks to investing

Capital Flows

In the world of finance understanding capital flows, following the smart money, aligning your capital with those that have insider information, cough Nancy Pelosi, generally results in positive outcomes.

Capital flows to where investors see the most value or return, inevitably it always ends up in speculation, leading to booms and busts.

It's not just what you know but who you know and imperatively, how fast.

Data is the new oil, this inevitably leads to retail investors chasing, being late to the party, it pays to be first and early, before they sell and dump on you.

Buy the rumour, sell the news. Markets are forwards looking, you need to be thinking about the next 6, 12, 18 months, not the present.

If you already know, I'm not interested. Being early to an investment theme exists in a Schrödinger-like state both genius and delusional, only the future collapses it into one reality, occasionally it's the latter.

Break: Isaac discovers a bubble.

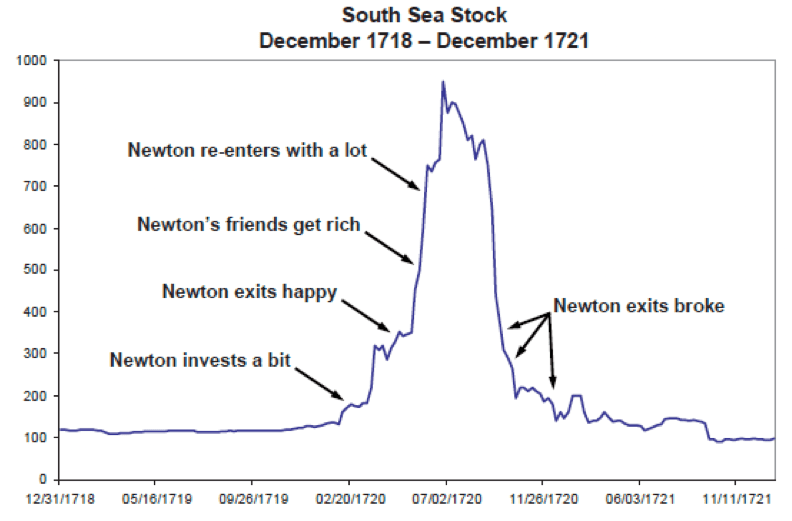

South Sea Bubble 1720

World’s first financial crash

The South Sea Bubble was the financial collapse of the South Sea Company in 1720. The bubble formed around slave trade, specifically African slaves to the Spanish and Portuguese Empires in Spanish America.

It was a British joint stock public and private partnership that was designed as a way of consolidating, controlling and reducing the national debt and to help Britain increase its trade and profits in the Americas.

A notable investor in this bubble was Isaac Newton, who developed his theory of universal gravitation, whilst he was away from Cambridge University due to the Great Plague in 1665-66.

Newton decided in the early stages of that mania that it was going to end badly and liquidated his stake at a large profit. But the bubble kept inflating and Newton jumped back in around the peak.

Drawdowns

Newton's Law of Gravity

Ironic, an intellectual who theorised the law of universal gravitation, found his capital flowing to a bubble that inevitably popped, chasing riches resulting in the only reality, an apple.

In the short run, the market is a voting machine. But in the long run it is a weighing machine - Benjamin Graham

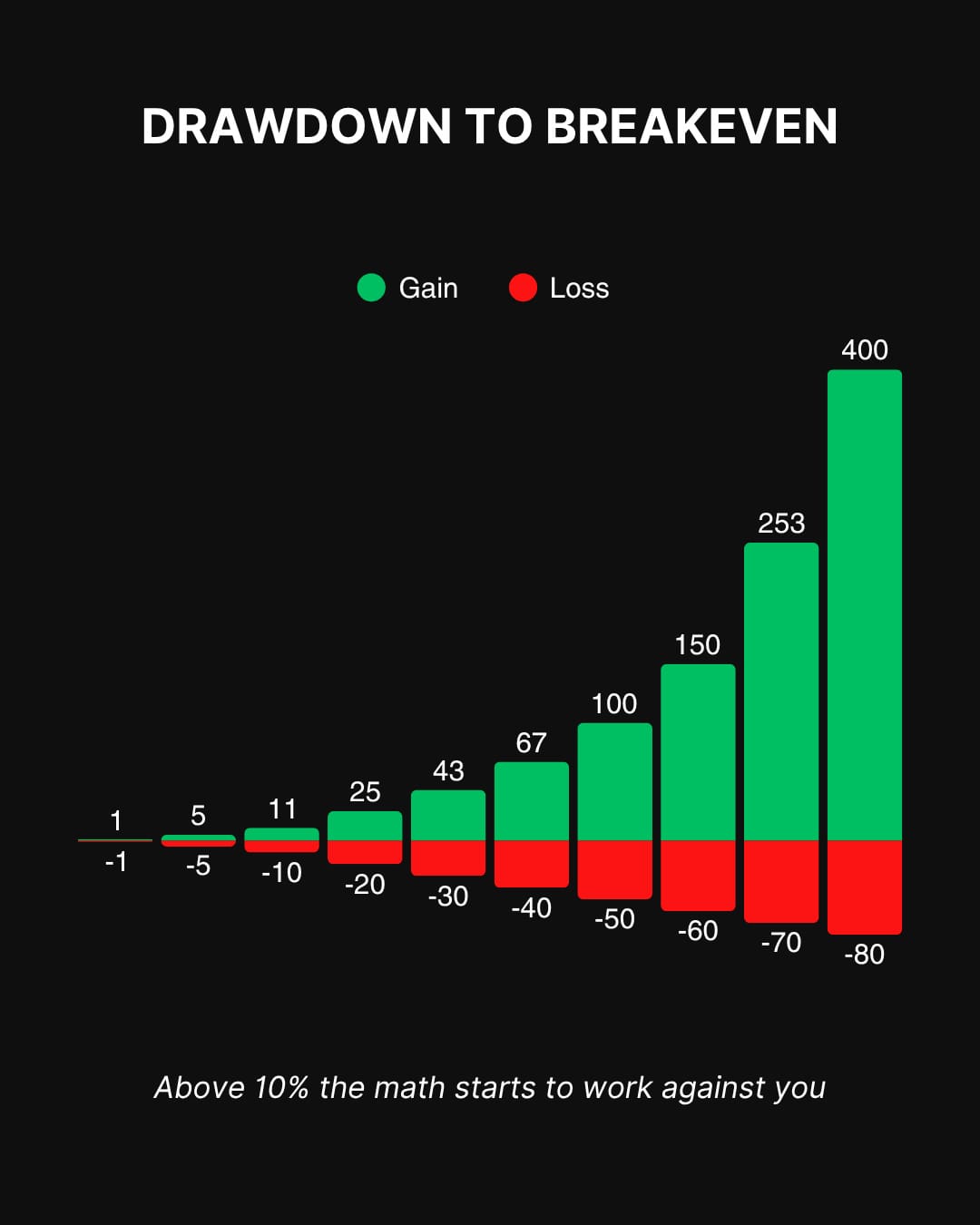

Drawdowns are our tether to Earth, they provide reality checks, not respected it destroys investors.

The best investors prioritise and minimise risk, the key to unlocking compounding consistently for improved risk adjusted returns.

Break: Isaac takes his hammer and smashes the apple

Breakeven

Commit this to memory!

RISK - Cheat Sheet

Stick this on your fridge

- Manage drawdown risk

- Refer to rule 1

- A great return means nothing, if you blow up afterward

- Compounding only works if you survive

- Pros obsess over drawdowns

- Amateurs obsess over returns

- Cash = flexibility, patience, control

- Be humble, manage ego & crush arrogance

- Breathe, don't rush to breakeven

Outperformance

Invest with models, training psychology

Investing requires understanding sentiment, you need to master your own emotions first, stay grounded and not be caught in the euphoria.

Bubbles come and go, busts will always happen. Models help to align with capital flows, catching the signal and tuning out the noise. Akin to natural laws, ignorance is blindness.

Multiple models build a system: the aim is to make the hammer smaller to avoid drawdown risk and capture upside risk.

Invest with risk adjusted return, maximising upside capture and minimising downside drawdown.

Being early, consistent, patient are the foundations of a great investor.

Isaac looks for his next model in solace... focused on hammers

Disclaimer

The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Please refer to our

Terms and Conditions.