Bankrupt Britain - Part 1

Today, this article marks the start of your journey into why in every crisis, lies an opportunity.

Knowledge is power, work smarter not harder and build unwavering conviction.

My goal is to inform the unaware, document my thoughts and help navigate the investing journey.

Since the creation of Bitcoin and the recent all time high in Gold price, the collapse of currencies is old news. The directional trend is clear, favouring real hard tangible or scarce limited assets, the narrative has been described as the debasement trade.

If you're new to investing or an accredited investor all members are welcome! The opportunity here for both is to create generational wealth in an ethical way.

I encourage all readers to refer to this video, reinforcing the debasement narrative thesis as a baseline before continuing.

A 200 year cycle may be proving prescient, although history does not repeat itself, it often rhymes.

We will explore the implications of the panic in 1825 on the present trajectory of GBPUSD aka the 'Cable' in FX markets, using technical and cycle theory; grab your favourite hot drink, we're going to dissect the past, politics and the Pound. This will affect everyone, especially those who save cash and keep most of their wealth in the U.K. and value everything in the Pound Sterling.

Disclaimer: Breathe, mentally prepare yourself, this is not the time to panic!

Technicals study price

A cycle paints a 1000 words

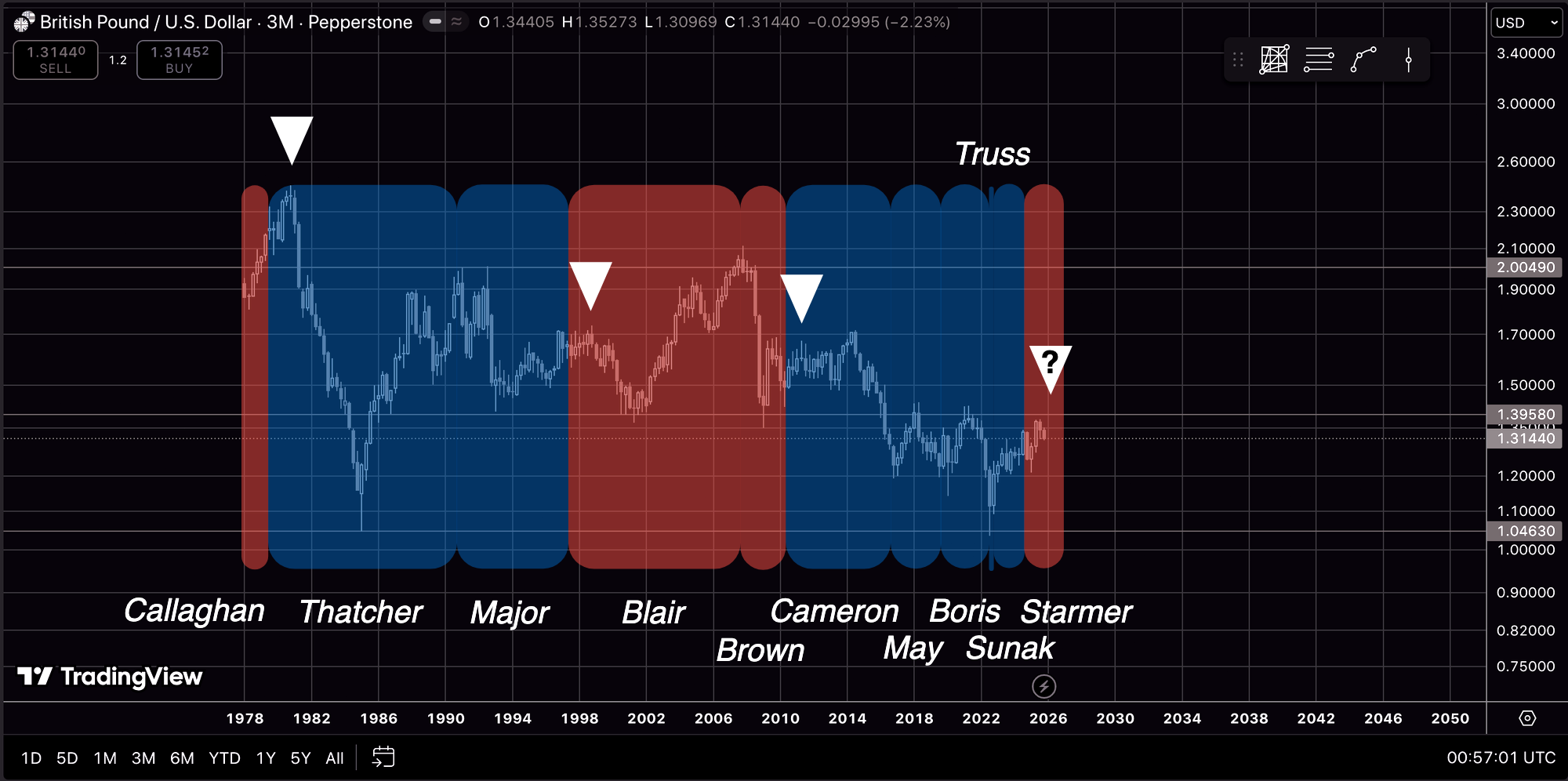

Setting the scene, current day sterling has broken a key support, now turned resistance struggling to breakthrough ~$1.40 (Fig 1).

'Cable' used to trade in a 30 year range from ~$1.40-$2 until something broke the Sterling... enter Brexit June 2016.

The new range exists between ~$1.05-1.40, reaching parity at $1 during the Liz Truss fiasco in 2022, prices not seen since 1985, a period of great inflation.

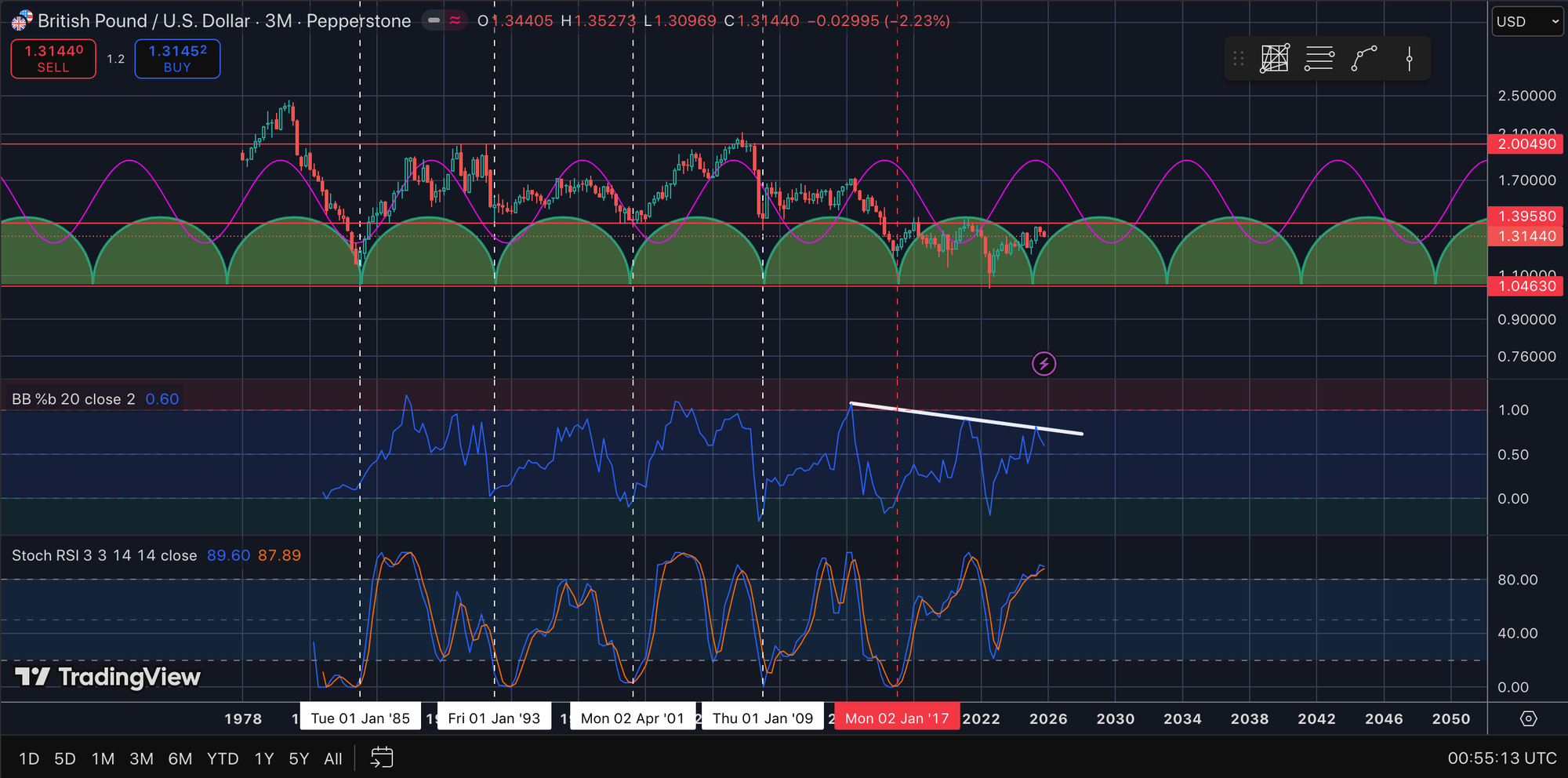

Sterling follows a salient cycle of 8 years indicated by troughs in white (Fig 2).

It appears as though the frequency of cycles had increased since Brexit in the latest iteration of the 8 year cycle trough. The short term cycle had distorted the long term cycle, resulting in increasing volatility in both time and price (Fig 3).

Coincidentally, volatility was also experienced within politics, specifically the conservative party highlighted blue in Figure 4 below. The only political commentary I can provide is Brexit led to the demise of the Conservative party showcased by the frequently revolving prime ministers in quick succession. The lead up to low in the Pound Sterling was marked with a government crisis in July 2022, involving a political scandal marking the largest such resignation in a single day since 1932, followed by the immediate low where Liz Truss became the shortest-serving Prime Minister in British history, resigning after 49 days in office, appointed by Queen Elizabeth II, two days before the monarch's death.

BREAK: Drink tea, if tea was not your hot drink of choice are you even a Brit?

When interpreting the political cycle there are 3 observations:

- The transition from one political party to the other, generally marks a brief rally based on hopes of this time is different, followed by a peak in Sterling (shown by white triangles Fig 4).

- A brief rally with each new prime minister, followed by an inevitable decline.

- The longest serving prime ministers in this time series, Thatcher and Blair, despite being political opposites, both forged strong relationships with Regan and Bush, the former presidents of the USA.

Present day following the blueprint. A political transition to the Labour party, brief rally in the Pound Sterling, hopes in Labour evaporating, reaching overhead resistance in GBPUSD, political climate is conducive with Starmer's approval ratings marking the lowest since tracking began in 1977.

A dark horse emerging, an alternate party to both conservative and labour, labelled Reform gaining prominence in polls, the leader Nigel Farage is close friends with the current president of USA, Donald Trump. All ominous signs for what lies ahead. A catalyst, the looming November 26 budget to be delivered by Rachel Reeves, a highly possible narrative for the start of the decline and ultimately devaluation.

Forecast

GBP Crash into 2028 - 2030s

To conclude, the 8 year cycle observed within Sterling, is currently in the timing window for a trough, however momentum indicators are rolling over and the formation of a bearish divergence has appeared building since pre-Brexit (Fig 5) .

Only explanation is the cycle has inverted and the Pound is peaking.

Models indicate a crash into 2028 potentially extending into 2030s.

BREAK: Breathe, keep calm and carry on drinking tea.

Disclaimer

The content is for informational purposes only; you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Please refer to our

Terms and Conditions.